As a military retiree, you have the option to continue coverage under the Survivor Benefit Plan (SBP). This program pays an annuity that is a percentage of your base pay after your death. The cost is deducted from your monthly retirement check by DFAS. It is important to keep your SBP election current. Ignoring it can cause you to accumulate a large debt or, in the case of spouse-only coverage, lose your survivor annuity entirely.

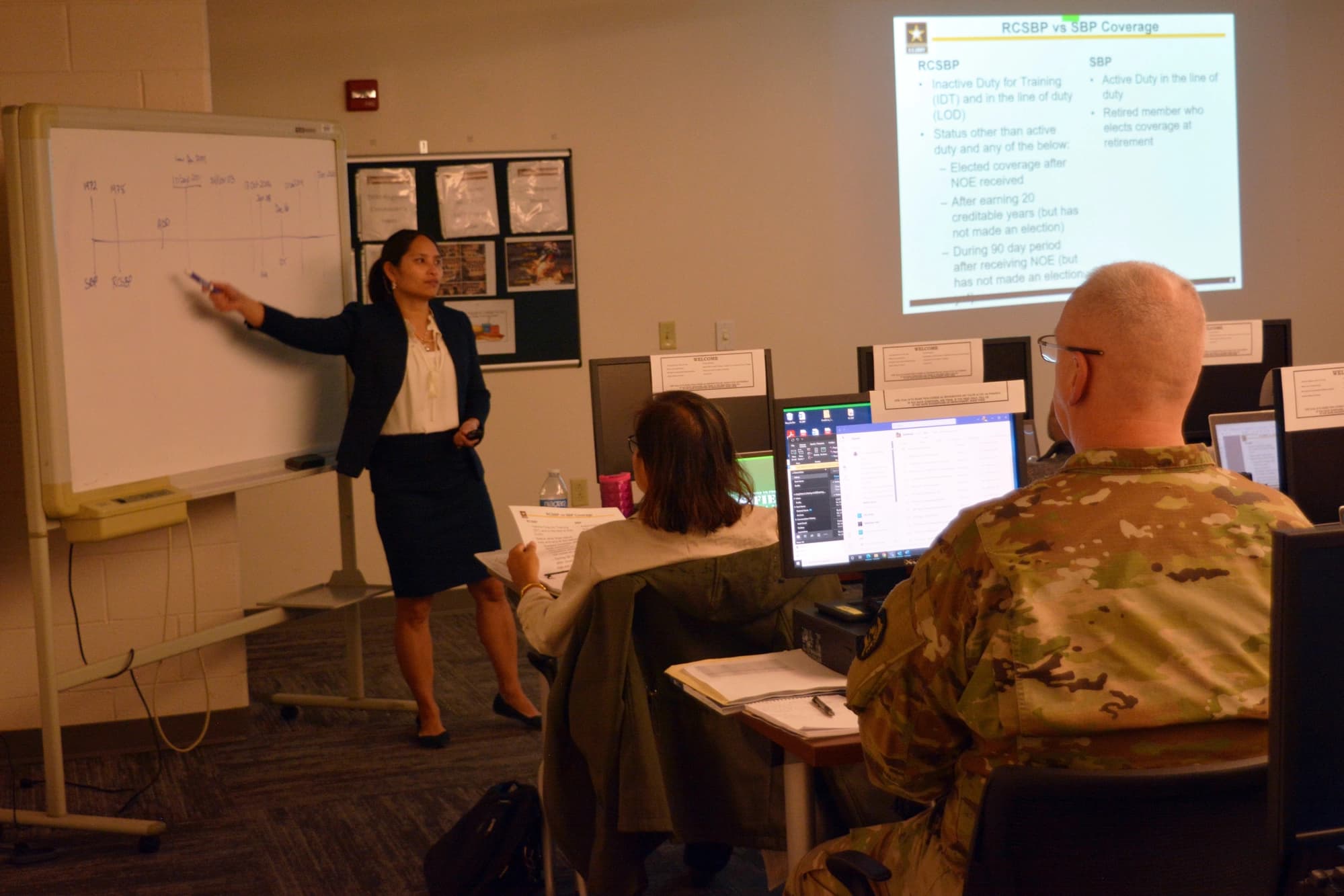

Currently, SBP covers up to 55 percent of a servicemember’s retired pay. It is available to all active duty, reserve, and National Guard members. However, service members must elect to participate and pay the premiums. Generally, service members will make the SBP election at retirement or after 20 years of satisfactory service. However, recent legislation has extended the availability of SBP to service members who become non-retirement eligible, such as when they die on active duty or who have a terminal illness.

Your RCSBP selection is one of the most important decisions you’ll make during your ’gray period,’ the transition from active duty to retirement for most National Guard and Reserve members. Your choice will determine who will receive your retirement annuity after you die and may affect how much of your VA DIC offset you’ll get. If you choose to discontinue RCSBP coverage, it cannot be reinstated until the next open enrollment period, which ends December 23 of 2022.

How to Apply for a Survivor Benefit Plan in the Army?

After military retirement, your spouse or children may need a stable source of income. You can provide them with this income by choosing to participate in the Survivor Benefit Plan (SBP). The SBP is an annuity that pays your beneficiary up to 55% of your military retired pay, adjusted for inflation, every month after your death. It is a taxable benefit, and you must choose to enroll in it before your retirement date.

The DFAS-Cleveland Center website offers a Survivor Benefit Plan calculator, which can help you compare the cost of SBP with life insurance. The tool can also help you determine which option is best for you. You can elect spouse-only coverage, former spouse coverage, or coverage for a person with insurable interest. Spouse-only coverage is the most popular choice, but it’s not your only option.

The VA Survivors Pension offers monthly payments to qualified surviving spouses and unmarried dependent children of wartime Veterans who meet certain income and net worth limits set by Congress. It can be applied for through a military casualty assistance officer, by using the QuickSubmit tool on AccessVA, or by mailing or visiting a regional office. Your SBP selection is one of the most important military retirement decisions you’ll make. Read on to learn more about this program and how to apply for it.